Haga clic aquí para español.

The Free Community Tax Service helps residents file their federal and Indiana tax returns for FREE and claim the EITC, if eligible.

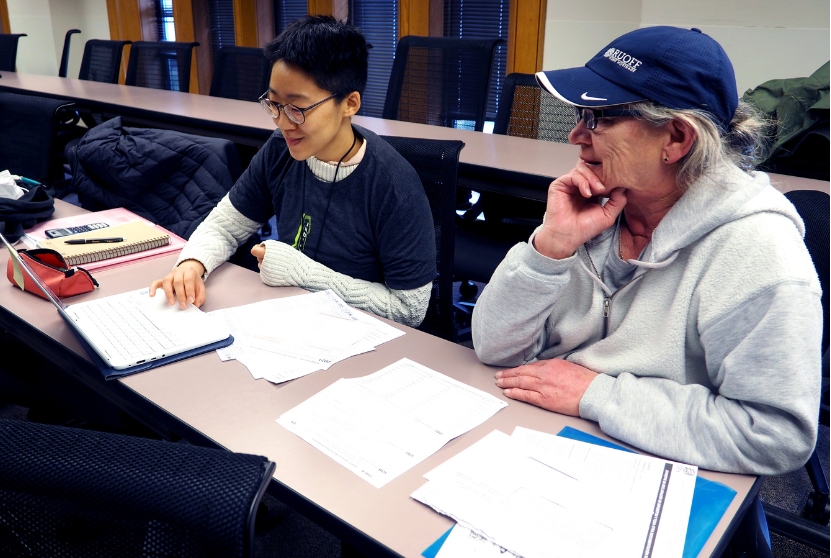

- Receive free personal tax preparation by a Certified Tax Preparer, in about an hour.

- Convenient on-site service locations in Brown, Monroe, and Owen counties.

- File your federal and state return for free.

- Call to make your appointment today.

- File for free from the comfort of your home or anywhere with an internet connection.

- Visit www.unitedwaysci.org/freefile to see which option is right for you.

If you are not eligible to use in-person services, explore options for filing online here.

Please note that two sites managed by AARP Tax-Aide Program do not have any income (or age) requirements for services.

IRS QUICK LINKS

The IRS encourages everyone to use the Tax Withholding Estimator to perform a quick "paycheck checkup." This is even more important following the recent changes to the tax law for 2018 and beyond.

The Estimator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work. There are several reasons to check your withholding, particularly if you have recently experienced a major life event (i.e. marriage, the birth of a child, adoption, or buying a home):

- It can protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year.

- At the same time, with the average refund topping $2,800, you may prefer to have less tax withheld upfront, so you receive more in your paychecks and get a smaller refund at tax time.

If you received unemployment income, it is likely you will owe some amount when you file your tax return. Ask your tax preparer about how to set up a payment plan to help you repay the tax you owe.

Visit the IRS central info hub for taxpayers, businesses, and others affected by the coronavirus. This page is updated as new information is available.

About the Free Community Tax Service:

The Free Community Tax Service helps residents file their federal and Indiana tax returns for free and claim the EITC, if eligible. United Way is proud to work with several local community organizations to help local residents retain more of their earnings.

In the 2023 tax season, the Free Community Tax Service program brought together 54 volunteers to help local residents file 865 federal returns, saving clients as much as $395,305 in tax preparation fees and bringing back more than $980,004 in refunds and credits. United Way managed 7 full-service tax sites, and AARP managed 2 sites. Clients reported using those funds and the $172,562 in EITC to pay for food, clothing, bills, and rent, and to put toward savings. 115 filers received EITC. Working families received $209,308 in child tax credits. The Free Community Tax Service helps many seniors in our community, who make up about 67% of the clientele.

In conjunction with personal finance classes, free financial coaching, and the Bank on Bloomington program, the Free Community Tax Service is a key component of United Way of South Central Indiana's financial stability initiatives.

The Free Community Tax Service is brought to you by these community partners:

United Way of South Central Indiana is the lead convener and sponsor of the Free Community Tax Service. This is one component of our financial stability initiatives. Services funded by United Way have a broad reach – touching 1 in 3 community members each year. To learn more about how United Way can assist you, visit www.UnitedWaySCI.org/FindHelp.

Along with United Way of South Central Indiana and Financial Stability Alliance, partners of the Free Community Tax Service include 2-1-1, AARP, Area 10 Agency on Aging Endwright Center East, Brown County Public Library, City of Bloomington, First Financial Bank, Indiana University Maurer School of Law, Ivy Tech Community College-Bloomington, MCCSC Broadview Adult Learning, Monroe County Public Library, Owen County Public Library, Regions Bank and community volunteers.