On Thursday, January 24, United Way of Monroe County and the Financial Stability Alliance for South Central Indiana launched the Free Community Tax Service season and joined national efforts to raise awareness of the Earned Income Tax Credit (EITC). Energetic representatives from the IRS, United Way, and partner organizations distributed local free tax assistance information and Free Community Tax Service chip clips to community members from 11:30 am - 1:30 pm at two area businesses. During the outreach event, approximately 270 individuals and families shopping at Walmart in Bloomington and at Babbs Super Valu in Spencer received information about the Free Community Tax Service and how to claim the valuable EITC.

“Free tax filing and claiming EITC are two important ways families can balance their home budgets. We encourage Hoosiers with low and moderate incomes to visit one of the Free Community Tax Service sites,” said United Way of Monroe County’s Executive Director Barry Lessow. “Once again, a team of strong community partners and dedicated volunteers responded enthusiastically to United Way Community Initiatives Director Ashley Hall. Thanks to them all for helping local working families remain financially stable in these tough times.”

“Free tax filing and claiming EITC are two important ways families can balance their home budgets. We encourage Hoosiers with low and moderate incomes to visit one of the Free Community Tax Service sites,” said United Way of Monroe County’s Executive Director Barry Lessow. “Once again, a team of strong community partners and dedicated volunteers responded enthusiastically to United Way Community Initiatives Director Ashley Hall. Thanks to them all for helping local working families remain financially stable in these tough times.”

Eloise Erickson, IRS Senior Stakeholder Relationship Tax Consultant, spoke about the importance of this community outreach, “The IRS is supportive and appreciative of our community partners and their outreach efforts. Through these partnerships, more community members will become aware of the Earned Income Tax Credit (EITC), a refundable federal income tax credit for low- and moderate income working individuals and families.”

The EITC is a refundable federal income tax credit that can offer a significant financial boost for eligible low- and moderate-income residents. This valuable tax credit can result in up to $5,891 for those who qualify. However, only four out of five of eligible residents claim and receive the refund. In order to claim the EITC, residents must file their tax returns, even if they are not required to do so.

Rebecca Nunley, Director of the RSVP 55+ Volunteer Program at Area 10 Agency on Aging commented, “RSVP is excited to partner with the Free Community Tax Service again this year. The Free Community Tax Service puts cash back into people's pockets at a time when they most need it. What a tremendous service, all free of charge! Kudos to all the volunteers who go through extensive training to serve our community in such an important and impactful way!”

“Twenty percent of the workers who qualify for the EITC fail to claim it. Millions of workers will qualify this year for the first time,” said Jamie Andree, Director of Indiana Legal Services’ Low Income Taxpayer Clinic. “Anyone with earnings under $50,000 should see if they qualify. There are many factors in addition to how much income you earn that determine your eligibility for and the amount of the EITC. Last year the average credit per household was $2,200. This year, the EITC can be as high as $5,891 depending upon the worker’s income, marital status, and whether they have children. Receiving the EITC can really make a difference!”

Ginger Rogers, Director of the Owen County Public Library, spoke about their involvement in the program, “I’m really pleased that Owen County Public Library is able to play a part in providing this service to the public. I feel really good about referring our patrons to a reliable source of tax help that doesn’t cost anything at all, not before taxes and not after. I’m impressed with the fact that these folks are looking out for the best interest of the public, even letting them know about the tax credits they may be able to claim.”

This income tax season Monroe and Owen County residents can file for the EITC and their taxes for free at one of ten Free Community Tax Service sites. These sites are staffed by IRS-certified volunteers who provide free tax preparation and electronic filing of federal and Indiana tax returns for low- and moderate-income residents. Last year the Free Community Tax Service sites helped file more than 2,680 returns for free, saving residents up to $500,000 in tax preparation fees.

According to Steve Englert, Accounting Program Chair/Assistant Professor at Ivy Tech Community College - Bloomington, “Ivy Tech Community College is proud to be involved with such a worthy community service since 2005. That first year we filed 100 returns and this past year we filed more than 700. So many of our clients come back to us year after year because we've built up a trust and rapport with them - and because we make them feel comfortable doing their taxes.”

Monroe County sites include the Monroe County Public Library Main and Ellettsville Branches, Broadview Learning Center, Indiana University Maurer School of Law, Ivy Tech Community College-Bloomington, South Central Community Action Program, and the Twin Lakes Recreation Center. For the third year, Owen County Public Library will also host a site. Residents who want to file on their own for free can visit a self-service site at WorkOne or go online at MyFreeTaxes.com/Bloomington. Mobile sites will visit locations like Bloomington Housing Authority, LifeDesigns, and Stone Belt.

Along with United Way of Monroe County and the Financial Stability Alliance for South Central Indiana, partners include 2-1-1, AARP, Area 10 Agency on Aging, Broadview Learning Center, City of Bloomington, El Centro Comunal Latino, Ellettsville Branch Library, Indiana Legal Services, Indiana University Maurer School of Law, Internal Revenue Service, Ivy Tech Community College-Bloomington, Monroe County Public Library, Owen County Public Library, South Central Community Action Program, Twin Lakes Recreation Center, Walmart, WorkOne Bloomington, and over 150 community volunteers

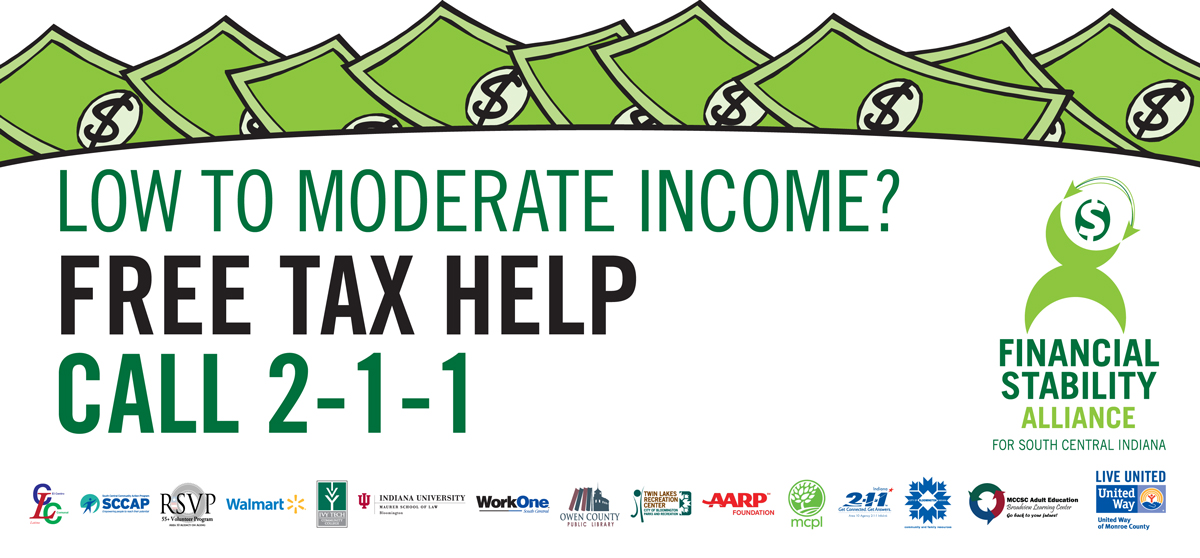

To learn more about the free tax preparation sites, EITC, and to see if they qualify, residents can call 2-1-1 or visit www.MonroeUnitedWay.org/FreeTaxes.